www.kviconline.gov.in – Overview on Prime Minister Employment Generation Program (PMEGP), PMEGP eTracking Status System, PMEGP Telangana, Gujarat, AP, Pmegp Online Application form for Non Individual…

Government of India came with a unique and noble thinking of helping the youth all over India to have employment is called PMEGP or Prime Minister Employment Generation Program. PMEGP official website is www.kviconline.gov.in. It will be done through establishing micro enterprises and for that government is going to help with the subsidized credit. PMEGP is made by combining two schemes, Prime Minister’s Rojgar Yojana (PMRY) and Rural Employment Generation Program (REGP). Both of the schemes were in work upto March, 2008.

Khadi and Village Industries Corporation came with this noble plan of Prime Minister Employment Generation Program with the help of the Ministry of Micro, Small and Medium Enterprises of Government of India.

In case you didn’t know, this credit-linked subsidy programmed was availed by the Indian government in 2008. Actually, it is a merger between Prime Minister’s Rojgar Yojana (PMRY) and Rural Employment Generation Programme (REGP). These two played a key role precisely in creating employment for the youth. By merging these two, the government was able to bring together rural and urban efforts thus leading to a unified approach when setting up micro enterprise. This in turn created employment for many people in all parts of the country.

The Objectives of PMEGP

Any scheme launched for citizens serves a given purpose fulfilled when the right personnel handles it. Things are no different when it comes to the PMEGP scheme since it has different objectives thus making sure it is invested in people of different caliber. To cut the long story short, here are the main objectives of the PMEGP scheme.

- Create employment in both rural and urban areas by setting up new self-employment projects and micro enterprises.

- Amplify the earning income capacity of artisans while at the same time boosting the growth rate of urban and rural employment.

- Offer a common working ground for both unemployed youth and traditional artisans in rural and urban areas. This action is aimed at bringing them together thus creating self-employment opportunities.

- Reduce rural to urban migration by providing stable and sustainable employment.

On 15th August, 2008, Prime Minister of India introduced PMEGP Online Registration for Gujarat, Andhra Pradesh and Telangana apply at kviconline.gov.in web portal.

KVIC

KVIC or Khadi and Village Industries Commission, is a government registered organization which works under Ministry of Micro, Small and Medium Enterprises of India. It came with a noble cause of providing employment among the people of India. Government of India’s PMEGP project is completely attached with KVIC as KVIC is playing the most important role in implementing this project in national and state level. Kviconline.gov.in is the official website for KVIC.

Purpose of PMEGP ePortal

As India Government started the digitization program in every service sector all over India to provide all Indians easy, handy and accurate result in every sector; they made ‘PMEGP e Portal’ as well to help us. It is made and maintained by the Directorate of Information Technology, KVIC Mumbai.Through this PMEGP e Portal, Individual, Bank and Agency can directly do their dealings online.

- If Individual wants to apply for PMEGP, he can do this by clicking ‘Online Application Form for Individual’.

- If anybody wants to apply for PMEGP Non-Individual, i.e. for Self Help Groups (SHG), Trust, Registered Institution or Co-Operative Societies; he can do this by clicking ‘Online Application Form for Non-Individual’.

- The Applicant who is already registered here, can directly login from this PMEGP e Portal and the candidate whose Margin Money has already released, can submit the feedback form from here.

- Agencies like KVIC, KVIB and DIC can login from PMEGP e Portal.

- DLTFC login and Financing Bank login can be done through this PMEGP e Portal.

- No middle man is allowed in any activities in the whole system.

Features of PMEGP Loan Scheme

The main role of PMEGP scheme is providing subsidies for starting a micro-enterprise thus making the venture successful. This is made possible thanks to the credit you get in the form of PMEGP loan. Some of the most notable features of PMEGP loan scheme you need to know include:

- Self-Investment

When it comes to self-investment, the PMEGP scheme looks into the location of your enterprise. If your enterprise is located in a plain terrain, then you’ll benefit from a maximum of Rs.1 lakh. Things tend to be different if the venture is on a hill since you are entitled to get a maximum of Rs. 1.5 lakhs.

- Quantum of Loan

Since PMEGP loan scheme is under the overall formula that is applicable to MSME, the amount of restrictions varies depending on what you have to offer. To give you a slight insight of what is expected, a manufacturer is entitled to a maximum of Rs.25 lakhs whereas a service has to make do with Rs.10 lakhs maximum.

- PMEGP Loan Interest Rate

What makes PMEGP scheme an option worth opting for is the fact that the interest rate is applicable in line with the bank’s norm for MSME enterprises? For those who might not know what we are talking about, the bank norm is in the range of 11% and 12% p.a. Nevertheless, things tend to be different under the Interest Subsidy Eligibility Certification (ISEC) scheme since the interest is 4% for both Working and Fixed Capital expenses. The Good news is the repayment schedule ranges from 3-7 years.

- Working Capital Requirements

Before opting for the PMEGP loan, you need to have a working capital expenditure that is equal to the cash credit limit. This should be done at least once in 3 years once the margin is already locked in. If this is not enough, it should never be below 75% of the sanctioned limit.

- PMEGP Loan Details

For you to get a clear picture of the PMEGP loan details, the fundamental parameter is broken down into two parts. First and foremost is the funding gap that is specifically offered as the Term Loan by banks. Aside from this, there is the specified category comprising people in SC/ST/OBC, Ex-defense service personnel, physically challenged, women and so on.

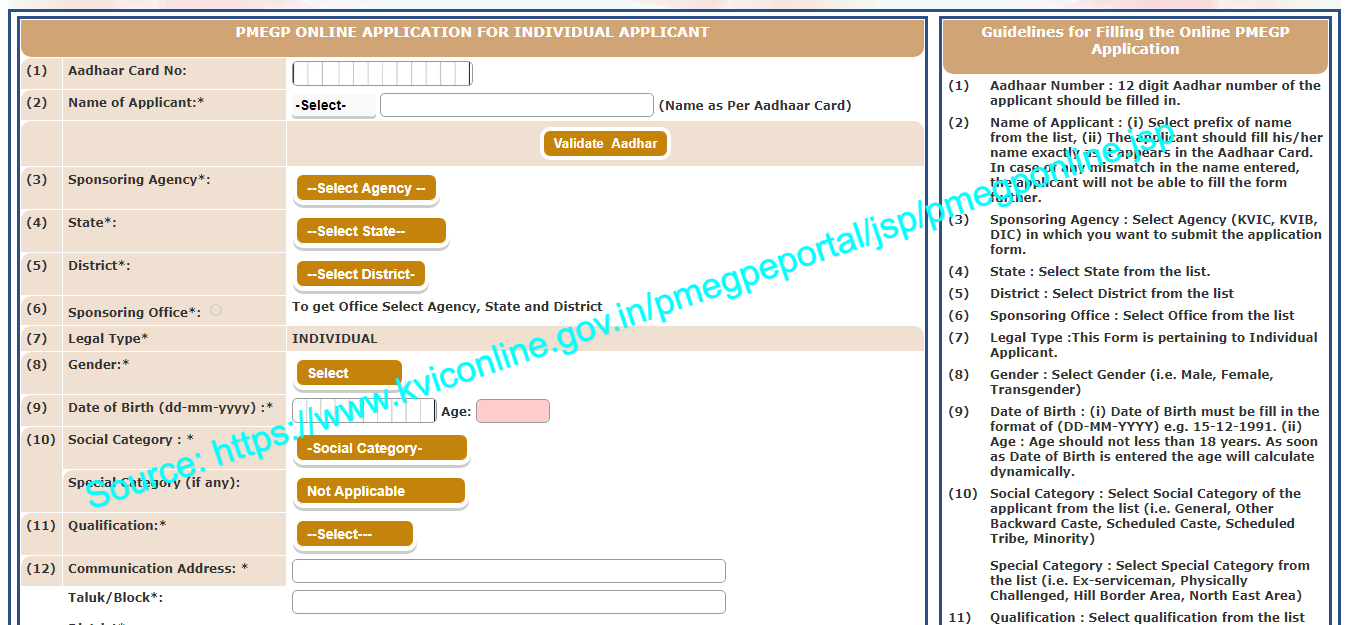

How to fill PMEGP Online Application Form for Individual at www.kviconline.gov.in

To fill the PMEGP Online Application Form for Individual, one has to go to the PMEGP e Portal page of website https://www.kviconline.gov.in/. In this page one can get the option, ‘PMEGP Online Application Form for Individual’ and has to click it. Then a form will be displayed and he has to fill it up.

- The applicant has to enter the 12 digit Aadhaar Card Number in the mentioned box.

- He has to select the prefix of the name and has to write the name as per the Aadhaar Card. Then he has to validate the Aadhaar.

- He has to select ‘Sponsoring Agency’ from the list.

- He has to select ‘State’ from the list.

- He has to select his ‘District’ from the list.

- He has to select ‘Sponsoring Office’ from the list.

- The Legal type of the applicant i.e. the form is for Individual is already written over there.

- He has to select the ‘Gender’ from the list.

- Date of Birth should be entered in dd-mm-yyyy format and according to that, age will be automatically calculated there.

- Social Category has to be selected from the list and if any Special category is there, that has also to be selected.

- Applicant has to select his qualification from the list.

- He has to write down his ‘Communication Address’ including Taluk / Block, District, Pin, Mobile Number, Email and PAN Number.

- He has to select his ‘Unit Location’ from the list i.e. whether it is rural or urban.

- He has to write down his full ‘Proposed Unit Address’ including Taluk/Block, District, Pin. If his Proposed Unit Address and Communication Address are same then he has to click on ‘Copy Communication Address to Unit Address’.

- He has to select the ‘Type of Activity’ from the list and select Industry or Activity.

- Applicant has to select the Industry or Activity Name and has to write the Product description he wants to work with.

- Then Choose either Yes or No as per the EDP Training it has taken or not.

- If you have chosen ‘Yes’ option i.e. EDP Training taken, then he has to write ‘TDP Training Institute Name’.

- Applicant has to fill up the ‘Project Cost’. He has to enter the expected ‘Capital Expenditure’ and ‘Working Capital’. Total Expenditure will be automatically calculated from that.

- He has to select the ‘1st Financing Bank’ from the list of bank names. He has to enter the IFSC Code, Branch Name, Address and District. If the bank’s IFSC Code is not known then he has to click ‘Select Bank IFSC Code and Address’.

- He has to select ‘Alternate Financing Bank Name’ from the list.

- He has to enter the ‘2nd Financing Bank IFSC Code’ and if the bank’s IFSC Code is not known then he has to click ‘Select Bank IFSC Code’.

- Select declaration form that all the information he put there, are correct.

- Then click on ‘Save Applicant Data’ button. After you can upload all the docs for the application’s final submission. After the completion of final submission, the Application ID and Password will come to the Applicant’s registered Mobile Number.

Procedure of filling PMEGP Online Application Form for Non-Individual at www.kviconline.gov.in/pmegpeportal

To fill the PMEGP Online Application Form for Non-Individual, one has to go to the PMEGP e Portal page of website kviconline.gov.in . In this page one can get the option, ‘PMEGP Online Application Form for Non-Individual’ and has to click it. Then a form will be displayed and he has to fill it up.

- The Applicant will get an option box where he has to choose the legal type of the Non-Individual, i.e. whether it is Self Help Group, Trust under Companies Act, Individual Registered Institution or Co-operative Society.

- The Applicant has to write the Name of the Firm under Companies Act.

- He has to enter the Registration Number.

- Registration date should be entered in the format dd/mm/yyyy.

- TAN Number should be entered.

- ‘Authorized Person Name’ should be entered.

- He should enter the ‘Designation’ of the Authorized Person. Aadhaar Number and PAN Number of Authorized Person should be entered.

- ‘Sponsoring Agency’ has to be selected from the list.

- ‘State’ has to be selected from the list.

- ‘District’ has to be selected from the list.

- ‘Sponsoring Office’ has to be selected from the list.

- Select ‘Gender’ from Woman and Not Applicable.

- ‘Social Category’ has to be selected from the list and select ‘Special Category’ if it is applicable.

- He has to write down his full ‘Office Address’ including Taluk/Block, District, Pin, Authorized Person’s Mobile Number, Office Telephone Number, Office Email and Bank Account Number.

- Unit location has to be selected from rural and urban.

- He has to write down his full ‘Unit Address’ including Taluk / Block, District, Pin. If his Unit Address and Communication Address are same then he has to click on ‘Copy Communication Address to Unit Address’.

- He has to select the Type of Activity from the list.

- Applicant has to select the Industry or Activity Name and has to write the Product description he wants to work with.

- He has to select Yes or No as per the EDP Training it has taken or not.

- If he has chosen ‘Yes’ i.e. EDP Training taken, then he has to write ‘TDP Training Institute Name’.

- Applicant has to fill up the ‘Project Cost’. He has to enter the expected ‘Capital Expenditure’ and ‘Working Capital’. Total Expenditure will be automatically calculated from that.

- He has to select the ‘1st Financing Bank’ from the list of bank names. He has to enter the IFSC Code, Branch Name, Address and District. If the bank’s IFSC Code is not known then he has to click ‘Select Bank IFSC Code and Address’.

- He has to select ‘Alternate Financing Bank Name’ from the list and enter 2nd Financing Bank’s IFSC Code.

- Applicant has to tick the declaration that all the information he put there, are correct. Then he has to click the ‘Save Applicant Data’ and upload all the documents for the application’s final submission. After the final submission, the Application ID and Password will come to the Applicant’s registered Mobile Number.

PMEGP e Tracking System or Pmegp Tracking Status

PMEGP e Tracking System is there so that no corruption can be done in the whole system. To use this PMEGP e Tracking System, one should go to the web page kviconline.gov.in. Here he can get ‘PMEGP e Tracking System’ option. Down there two options are available, ‘Official Login’ and ‘Application Status View’. One can do the ‘Official Login’ if he has his User ID Password. By entering Applicant ID and then pressing ‘View Status’, one can get to know his status.

PMEGP Loan: The financial help in PMEGP:

- 25 lakhs is maximum production cost in manufacturing sector.

- 10 lakhs is maximum production cost in business and service sector.

- In general category, people can get subsidy of 15 % in urban sector and 25% in rural sector; personal contribution of the person will be 10 % of the total cost and the rest will be borne by the bank.

- In Special category, people can get subsidy of 25 % in urban sector and 35% in rural sector; personal contribution of the person will be 5 % of the total cost and the rest will be borne by the bank.

- Special category includes people of Schedule Caste, Schedule Tribe, other minority groups, disabled persons, ex-serviceman and MBC.

The norms for PMEGP Help:

- There is no ceiling of Income for the Project Set Up.

- The maximum cost of production in the manufacturing sector is 25 lakhs where as in service sector it is 10 lakhs.

- The fund investment should not be more than 1 lakh in plain areas where as in hilly areas it should not be more than 1.5 lakhs.

- Any unit which is already under any central or state government help or subsidy is not eligible for PMEGP.

- PMEGP is only for the new set ups, not for any existing one.

- Project should be carried out by state KVIC and KVIB in rural areas and by District Industries Centers in rural and urban areas.

The Eligibility for PMEGP help:

Academic qualification is class 8 pass, for the project 10 lakhs worth manufacturing sector and 5 lakhs worth business and service sector. The candidate should be more than 18 years of age for the online application of PMEGP.

I am 43 yrs old.

Can i apply for pmegp.

Project is for polyhouse.

I am 37yrs old. can I apply for pmegp. project is for medicine distrebuitor.

am applied kvic

he also but nobady respone my call how contact

Sir, I am 22 years old and I want to set up bakery industry on my own land belonging to rural area near NTPC kahalgaon,Bhagalpur,Bihar.Can I get a loan under PMEGP scheme ? Plzz tell me sir. How can I get this?

Karnal se ho to m apki help kr skta hu

I am 26 years old can i get loan for cybercafe and studio sir please reply me

i need a contact number pls send if possible

సర్ నేను pmegp లోను అప్లై చేసి యున్నాను మొబైల్ నెంబర్ వేరే వాళ్ళ నెంబర్ అయి ఉన్నది అతను నాకు యూసర్ id పాస్వర్డ్ ఇవ్వడంలేదు నేను మరల వేరే అప్లికేషన్ పెట్టుకుంటే ఆల్రెడీ register అయినది అని అంటున్నది నేను లాగిన్ అవ్వడం ఎలాగ

We are carrying the Ngo working in urban area.so we want to generate more employment in village area. pl. help, how to get suport

Sir Delhi Mai office ke phone no. De please

I am Girish Chandra Nayak, Gajapati, Odisha, I am interested to start a small business, How to link PMEGP loan can you suggest.

मुझे पी एम ई जी लोन चाहिए मुझे बिजनेस शुरू करने के लिए

I am 43 years old and I want to purchase a three wheeler for commercial purpose , can I take a loan for this purpose

Sir IAM 29 years old I want to establish vehicles parts industry in BARBIGHA IAM btech in mechanical engineering.

Dear sir mujhe loan chahie request form dairy farm

My name is MD munna and 28 years old my business National electronics sales and service please help me I want to loan

Jo bhai karnal se h m thodi bhot help kr skta hu uski kyuki humne bhi family me kraya tha ye loan